Decentralized trading with features similar to centralized exchanges was something many crypto traders felt was missing in their journey. While centralized exchanges are efficient, the idea of them controlling your funds—coupled with incidents like market crashes where you couldn’t buy or sell coins—raised significant concerns. Perpetual DEXs put control back in the hands of users. Though there are a few drawbacks, they offer a simple and cost-effective way to start your decentralized trading journey. In this guide, we’ll explore the top 6 Perp DEX platforms available today, comparing them head-to-head to help you choose the one that best suits your needs.

Destaques:

- Decentralized platforms offer greater control over personal assets, eliminating the need for intermediaries.

- Users retain full ownership and custody of their funds, enhancing security and reducing risk of third-party breaches.

- Transparent and trustless environments are created, allowing traders to execute orders without relying on centralized authority.

- Perpetual DEXs offer more flexible and diverse trading options, making them a popular choice among active traders.

Top 5 DEX Perpétuo

After conducting thorough research and based on personal use, we decided to rank all the Perpetual DEXs based on security, supported chains, fees, and the products and services they offer. Based on this, the following is our list of the Top 6 Perpetual DEXs:

- hiperlíquido – Best for High-Performance Trading

- dYdX – Best for the Most Cryptocurrency Options

- ApolloX – Highest Leverage Perp DEX

- Hélice – Best for Bot Trading

- Vértice – Lowest Fees Perp DEX

- Gains Trade – Best for Diverse Product Offerings

| Plataforma | Criptografia Spot | Contrato Futuro | Valores | Alavancagem | Taxas de gás | No. of Chains | Volume Diário |

|---|---|---|---|---|---|---|---|

| 1. hiperlíquido | 11+ | 149+ | 0.01% / 0.035% | 50X | Não | 1 | $ 9.88B |

| 2. dYdX | N/D | 179+ | 0.02% / 0.05% | 50X | Sim | 5 | $ 0.86B |

| 3. ApolloX | 97+ | 97+ | 0.02% / 0.07% | 250X | Não | 7 | $ 1.23B |

| 4. Hélice | 43+ | 43+ | -0.01% / 0.01% | 50X | Não | 1 | $ 0.56B |

| 5. Vértice | 58+ | 58+ | 0.00% / 0.02% | 20X | Não | 4 | $ 0.34B |

| 6. Gains Trade | 206+ | 206+ | 0.08% / 0.08% | 200X | Não | 4 | $ 0.12B |

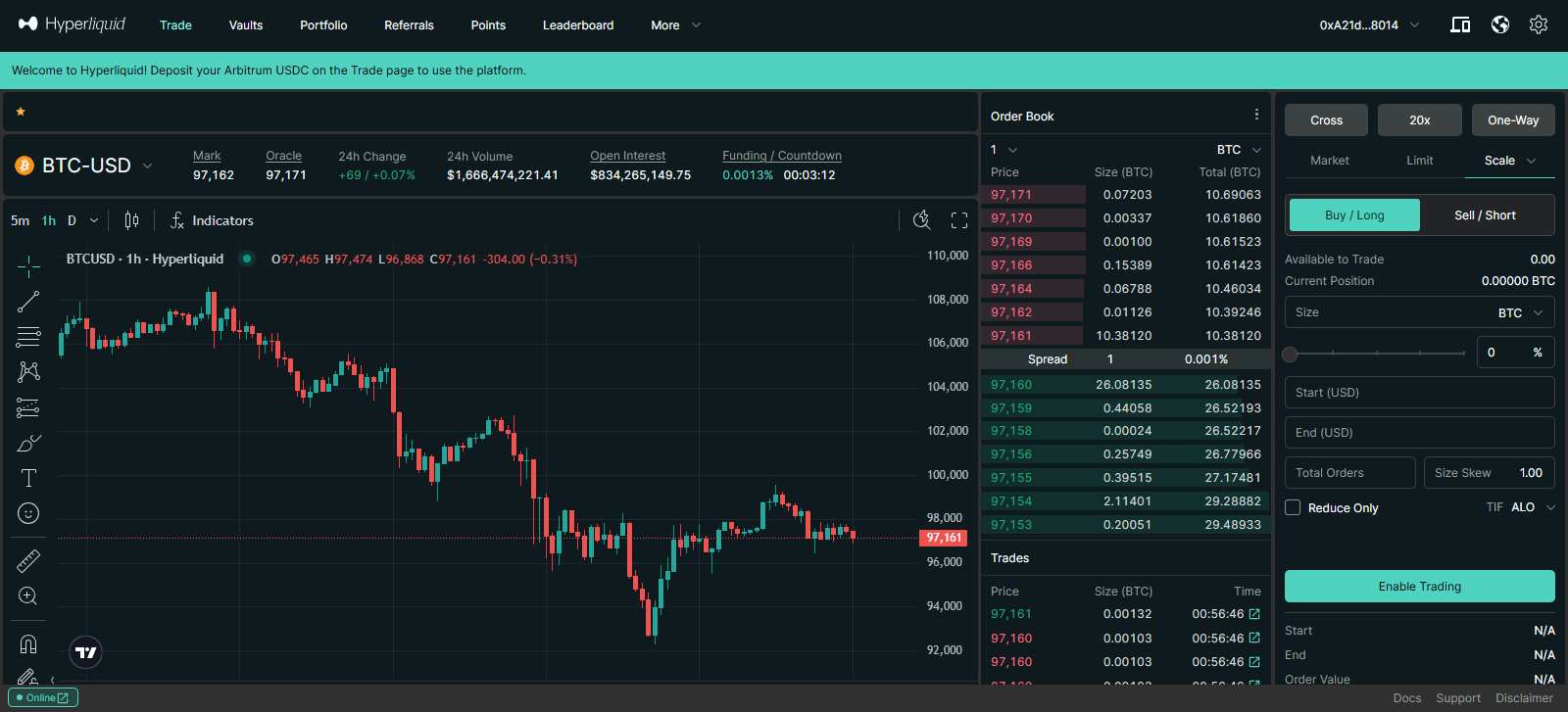

hiperlíquido

hiperlíquido is a decentralized exchange (DEX) built for high-performance trading with a focus on reliability and security. It consistently leads in daily trading volume and offers up to 50x leverage on perpetuals. The platform features its own Layer 1 blockchain, designed specifically for DeFi, ensuring optimized performance and minimal latency. hiperlíquido supports a range of cryptocurrencies, with 149+ futures and 11+ spot markets, and offers zero gas fees and no slippage, making it highly efficient.

The platform utilizes the $HYPE native token, which can be easily purchased either through the Perp DEX or on centralized exchanges like chato. With a strong focus on security, Hyperliquid undergoes regular smart contract audits. The platform also provides vaults for staking, copy trading, advanced order types, and a traditional order book system that prioritizes price-time matching.

Built on the Arbitrum chain, Hyperliquid benefits from its fast and scalable infrastructure, supporting 100,000 orders per second. With a 24-hour derivatives trading volume of $9.88B, Hyperliquid offers users a seamless and efficient trading experience.

Prós e contras do Hyperliquid

| 👍 Prós do Hyperliquid | 👎 Contras do Hyperliquid |

|---|---|

| ✅ Alta liquidez | ❌ Cadeias limitadas suportadas |

| ✅ Deslizamento zero | ❌ Menos opções de negociação à vista |

| ✅ Totalmente descentralizado | ❌ Sem suporte fiduciário |

| ✅ Sem requisitos KYC | |

| ✅ Autocustódia (DEX) |

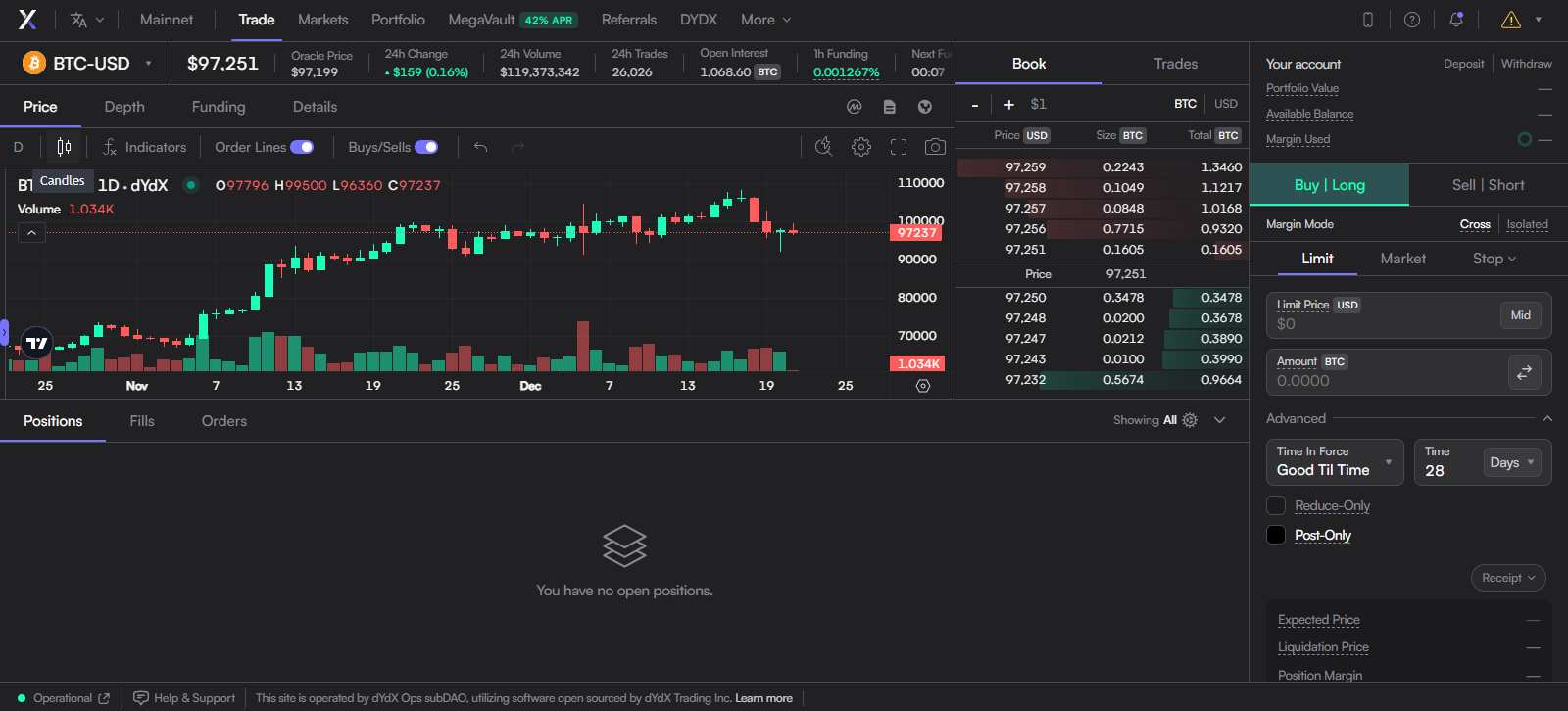

dYdX

dYdX is a well-established decentralized exchange built on Ethereum, offering an extensive range of trading pairs and a strong focus on futures and margin trading. It supports up to 50X leverage and is powered by ZK rollup technology through StarkEx. dYdX has 179+ futures contracts available and boasts a 24-hour derivatives trading volume of $864.41 million.

While it does not offer spot trading, its futures market is highly liquid with deep liquidity and advanced order types. Users can instantly earn $DYDX, the platform’s native token, after each trade. With a strong security infrastructure, including smart contract audits, an insurance fund, and full nodes maintaining an in-memory order book, dYdX ensures secure transactions.

It supports five chains, offering a variety of assets, and includes a Megavault feature that offers up to 43% APR. However, the platform’s feature set is somewhat limited compared to other DEXs, making it ideal for users primarily focused on derivatives trading. You can also buy the $DYDX token directly on the platform or on CEXs like Binance.

dYdX Pros and Cons

| 👍 dYdX Pros | 👎 dYdX Cons |

|---|---|

| ✅ Troca altamente regulamentada | ❌ No spot trading available |

| ✅ Maiores medidas de segurança | ❌ No demo trading options |

| ✅ Muito fácil de usar | ❌ Limited earning opportunities for users |

ApolloX

ApolloX stands out as a decentralized exchange offering high-leverage trading, with up to 250X leverage for crypto and up to 1000X for forex. It supports five chains, including Binance Smart Chain, and offers both order book and on-chain perpetuals for a diverse trading experience.

The platform features over 97 futures contracts on its V1 platform and 29+ on V2, focusing primarily on derivatives, with no spot trading available. ApolloX V1 uses off-chain transaction matching and on-chain fund settlement for high performance. V2 switches to a fully on-chain liquidity model for transparent trades and minimal slippage. With a 24-hour derivatives trading volume of $37.96 million, ApolloX also offers liquidity pools, governance through its DAO, and a staking option with its native token, $APX, allowing users to earn through the APX pool.

Additionally, demo trading is available on Arbitrum Sepolia. ApolloX is known for its security, with regular smart contract audits to ensure safety. Traders can enjoy zero slippage, competitive fees (0.02% to 0.07%), and access to forex and commodities markets. $APX, the platform’s native token, is available for purchase on major CEXs such as BingX or directly through the platform.

ApolloX Pros and Cons

| 👍 ApolloX Pros | 👎 ApolloX Cons |

|---|---|

| ✅ Highest leverage available (up to 1000x) | ❌ Limited features compared to competitors |

| ✅ Zero slippage on trades | ❌ Lower daily trading volume |

| ✅ Demo trading available for new users | ❌ Higher fees (0.02%-0.07%) |

| ✅ Supports the most number of chains |

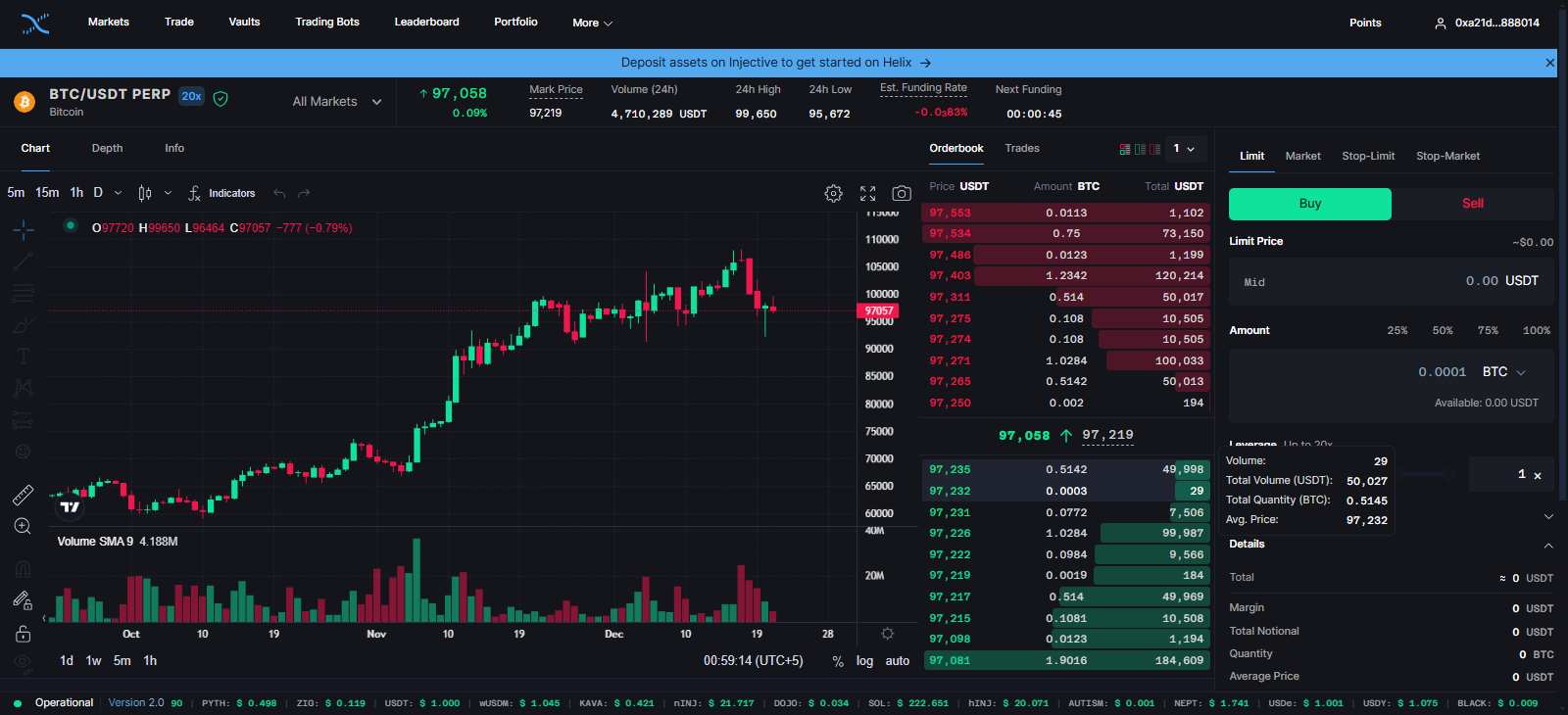

Hélice

Hélice is a decentralized exchange built on the Injective Protocol, offering both spot and derivatives trading with a focus on cross-chain crypto assets and perpetual markets. It stands out for its unique fee structure, with a maker rebate of -0.01% and a taker fee of 0.1%, alongside up to 50% discounts on taker fees.

The platform supports Injective Protocol exclusively and provides up to 50X leverage on its futures contracts, with over 43 contracts available. Helix also offers spot trading pairs in USDT and INJ, with more than 23 cryptocurrencies on offer. Traders can take advantage of zero gas fees, no slippage, and liquidity pools in the vaults to earn. While the platform has no native token, it ensures a transparent and secure trading environment with decentralized order books.

Helix allows users to trade without deposit or withdrawal fees, making it a cost-effective choice for those seeking an efficient, decentralized trading experience. Helix also provides advanced trading tools and supports bots, further enhancing the platform’s offerings. With a 24-hour futures trading volume of $34.8 million, Helix continues to expand its capabilities in the DeFi space.

Helix Pros and Cons

| 👍 Helix Pros | 👎 Helix Cons |

|---|---|

| ✅ Offers trading bots for automation | ❌ Supports only 1 chain (Injective) |

| ✅ Negative maker fees and discounts on taker fees | ❌ Fewer futures contracts (43+) |

| ✅ Zero gas fees for transactions | ❌ Relatively low daily trading volume ($34.8M) |

| ✅ Vaults for liquidity pools and earning options |

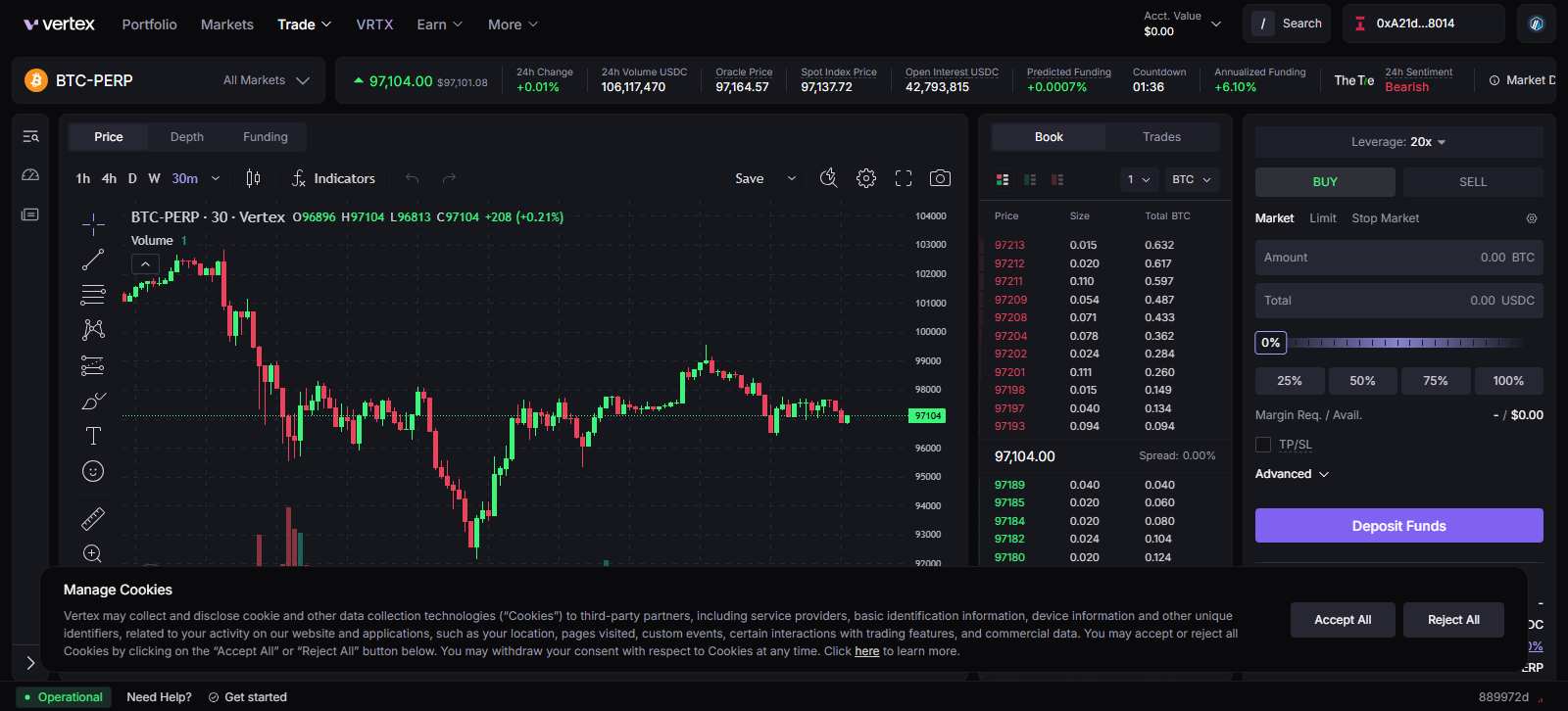

Vértice

Vértice is a next-generation decentralized exchange (DEX) built on Arbitrum, offering a hybrid order book-AMM model that ensures low slippage and high transaction efficiency. With a focus on providing low fees, Vertex offers up to 20X leverage on its trading pairs, which include more than 58 futures contracts and over 5 cryptocurrencies available for spot trading. The platform supports four chains and boasts a 24-hour derivatives trading volume of $663.19 million.

Vertex offers liquidity pools and various earning opportunities, including lending/borrowing features, vaults, and the ability to stake its native $VRTX token on the platform and on CEXs like Bybit. Its unified liquidity model allows users to trade across spot, perpetuals, and embedded money markets, creating a seamless and versatile environment. Vertex is designed to cater to traders of all experience levels, from casual users to seasoned professionals, redefining the decentralized trading landscape with its advanced features and low fees.

Vertex Pros and Cons

| 👍 Vertex Pros | 👎 Vertex Cons |

|---|---|

| ✅ Lowest fees (0.00%-0.02%) | ❌ Limited leverage (up to 20x) |

| ✅ Hybrid order book-AMM model ensures liquidity | ❌ Fewer cryptocurrencies on spot (5+) |

| ✅ Multiple earning options (liquidity pools, staking) |

Gains Trade

Gains Trade, also known as gTrade, is a decentralized trading platform that offers an extensive range of products, including forex and commodity pairs, making it a versatile choice for traders. Built on four chains, Gains Trade supports over 206 futures contracts, with no spot trading available. It provides traders with up to 200X leverage on crypto, along with a wide array of synthetic pairs, including USDC.

The platform charges a fee of 0.08% for both makers and takers and supports low slippage to enhance trading efficiency. Gains Trade also integrates a fiat on-ramp, allowing users to purchase crypto via credit or debit cards, and features an integrated bridge for easier cross-chain transfers. The platform’s native token, $GNS, can be staked to earn rewards, and users can also participate in liquidity pools to increase their earnings. The native token can be purchased directly on the Gains Trade platform or from a CEX like Blofin.

Additionally, Gains Trade hosts trading contests and offers demo trading on the Arbitrum Sepolia network. With over 28K active traders and a 24-hour derivatives trading volume of $77.72M, Gains Trade stands out for its capital-efficient synthetic architecture, low fees, and the flexibility it offers with leverage up to 150X on crypto, 1000X on forex, and 250X on commodities.

Gains Trade Pros and Cons

| 👍 Gains Trade Pros | 👎 Gains Trade Cons |

|---|---|

| ✅ Most diverse product range | ❌ No spot trading available |

| ✅ Offers up to 200x leverage | ❌ Higher trading fees (0.08%/0.08%) |

| ✅ Demo trading and trading contests available | ❌ Lower daily trading volume ($37.96M) |

| ✅ Integrated fiat on-ramp for convenience |

What Are Perpetual DEXs?

Perpetual DEXs (Decentralized Exchanges) are platforms that allow users to trade perpetual contracts directly on the blockchain, without relying on intermediaries like centralized exchanges (CEXs). These exchanges are non-custodial, meaning users retain control over their funds at all times. Perpetual contracts are unique financial instruments that allow traders to speculate on the price of assets without an expiration date.

Unlike traditional exchanges, Perpetual DEXs operate using smart contracts, which automatically execute trades based on predefined conditions. This decentralization reduces the risk of hacking and censorship but previously presented challenges like high gas fees and slippage. However, with the development of Layer 2 solutions and improved smart contract efficiency, Perpetual DEXs are becoming increasingly competitive with centralized platforms, offering low fees, better security, and enhanced privacy for traders.

Key Features of Perpetual DEXs

- Descentralização: Perpetual DEXs operate on blockchain-based smart contracts, eliminating the need for third-party intervention. Actions are autonomously executed according to pre-programmed conditions, ensuring decentralized operations.

- Sem custódia: These platforms do not hold users’ assets. Unlike centralized exchanges (CEXs), where a central authority controls private keys, users retain full control over their funds, reducing the risk of hacks and mismanagement.

- Permissionless: Anyone with a compatible crypto wallet can access these platforms without requiring approval, KYC (Know Your Customer), or account verification. This open-access nature reinforces their decentralized ethos.

- Leveraged Trading and Never-Ending Contracts: Perpetual DEXs offer the ability to leverage positions, enter long or short trades, and hold positions indefinitely, as long as collateral is sufficient. Traders can also exit positions at any time and claim their margin.

- Order Book Trading Models: Some perpetual DEXs integrate order book models, combining the familiarity of traditional centralized exchanges with the benefits of decentralization. This model ensures greater transparency and liquidity management.

- Pools de liquidez: Automated Market Makers (AMMs) rely on liquidity pools to provide continuous market liquidity. These pools are funded by liquidity providers (LPs), who are compensated with a share of the transaction fees generated by the platform.

DEX vs. CEX

| Característica | Perp DEX | CEX |

|---|---|---|

| Controle | Decentralized, user-controlled | Centralized, controlled by the exchange |

| Custódia de Fundos | Non-custodial (users manage their own assets) | Custodial (exchange holds users’ funds) |

| Anonimato | Offers privacy, no KYC required | KYC/AML verification required |

| Liquidity Model | Liquidity Pools or Order Book | Centralized order book |

| Valores | Generally lower, no intermediaries | Can be higher due to middlemen costs |

| Facilidade de uso | Requires wallet and blockchain knowledge | User-friendly, easy to onboard |

| Ativos suportados | Limited compared to CEXs | Wide range of assets, including fiat |

| Velocidade | Depends on blockchain congestion | Faster due to centralized infrastructure |

| Transparência | Fully transparent on blockchain | Limited transparency on transactions |

Bottomline

Perpetual DEXs allow users to trade in a decentralized manner, offering a simple wallet connection to begin trading. Users can easily start trading on the platform without the need for email sign-ups or other lengthy processes. Our list of the top 6 Perp DEXs covers the best platforms currently available, each with unique offerings. When choosing the right DEX, consider your trading priorities and the platform’s strengths.

FAQs

1. What is the key difference between perpetual DEXs and traditional DEXs?

While traditional DEXs focus on spot trading, perpetual DEXs allow trading perpetual contracts without expiration dates, enabling traders to speculate on asset prices with leverage and flexible timeframes.

2. How do perpetual DEXs handle leverage trading without central authority?

Perpetual DEXs rely on smart contracts to manage collateral and liquidation automatically, ensuring that leverage is enforced transparently without the need for intermediaries.

3. Are perpetual DEXs safe for beginners?

Perpetual DEXs require some understanding of blockchain and crypto wallets. However, many platforms now offer user-friendly interfaces and demo trading features, like ApolloX, to help newcomers practice before committing funds.

4. What are the risks associated with Perp DEX?

Trading on perpetual DEXs comes with risks like smart contract exploits, oracle manipulation, and flash loan attacks, which can lead to fund losses or unfair liquidations. Other risks include low liquidity causing slippage and centralization or governance flaws impacting platform security.

5. Do perpetual DEXs support multi-chain interoperability?

Yes, many perpetual DEXs like dYdX and ApolloX support multiple blockchain networks, enabling users to trade assets across chains seamlessly.